All Categories

Featured

Table of Contents

A PUAR permits you to "overfund" your insurance coverage policy right up to line of it coming to be a Modified Endowment Contract (MEC). When you make use of a PUAR, you rapidly boost your money value (and your survivor benefit), consequently increasing the power of your "financial institution". Better, the even more cash worth you have, the greater your passion and reward repayments from your insurer will be.

With the surge of TikTok as an information-sharing system, monetary recommendations and strategies have actually located a novel method of spreading. One such technique that has been making the rounds is the limitless financial idea, or IBC for short, amassing recommendations from celebs like rap artist Waka Flocka Flame. However, while the approach is currently preferred, its origins map back to the 1980s when economic expert Nelson Nash presented it to the globe.

Is there a way to automate Financial Leverage With Infinite Banking transactions?

Within these plans, the cash money value expands based on a price set by the insurance provider (Privatized banking system). When a substantial cash worth collects, insurance holders can obtain a cash worth finance. These finances vary from standard ones, with life insurance policy offering as collateral, implying one can shed their coverage if borrowing exceedingly without adequate cash worth to support the insurance policy costs

And while the appeal of these policies appears, there are natural limitations and dangers, demanding diligent money worth surveillance. The approach's authenticity isn't black and white. For high-net-worth people or local business owner, especially those making use of methods like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and substance growth can be appealing.

The allure of unlimited financial does not negate its difficulties: Cost: The fundamental need, an irreversible life insurance policy policy, is pricier than its term counterparts. Eligibility: Not every person gets entire life insurance policy due to extensive underwriting processes that can omit those with details wellness or lifestyle problems. Intricacy and risk: The intricate nature of IBC, combined with its dangers, may discourage numerous, specifically when simpler and much less risky alternatives are available.

How does Private Banking Strategies create financial independence?

Allocating around 10% of your monthly revenue to the policy is simply not feasible for many individuals. Component of what you read below is merely a reiteration of what has currently been stated above.

So prior to you get yourself right into a scenario you're not prepared for, recognize the adhering to first: Although the idea is generally marketed because of this, you're not really taking a lending from on your own. If that held true, you wouldn't have to settle it. Instead, you're obtaining from the insurer and need to settle it with rate of interest.

Some social media sites articles recommend using cash money value from entire life insurance to pay for charge card debt. The concept is that when you pay back the lending with interest, the amount will be sent back to your investments. That's not how it works. When you pay back the loan, a part of that interest mosts likely to the insurance firm.

For the initial a number of years, you'll be repaying the compensation. This makes it incredibly difficult for your plan to collect value throughout this time around. Entire life insurance policy prices 5 to 15 times a lot more than term insurance policy. Lots of people just can't manage it. So, unless you can manage to pay a couple of to several hundred bucks for the next years or more, IBC will not benefit you.

How do I qualify for Cash Value Leveraging?

If you call for life insurance, right here are some beneficial suggestions to take into consideration: Consider term life insurance policy. Make certain to go shopping around for the best rate.

Visualize never ever having to worry regarding bank finances or high interest rates once more. That's the power of limitless financial life insurance policy.

There's no set car loan term, and you have the freedom to pick the settlement schedule, which can be as leisurely as paying back the finance at the time of fatality. Infinite Banking wealth strategy. This flexibility reaches the servicing of the financings, where you can choose for interest-only payments, keeping the financing equilibrium level and convenient

Holding money in an IUL repaired account being credited interest can often be much better than holding the money on down payment at a bank.: You have actually constantly imagined opening your own bakeshop. You can borrow from your IUL plan to cover the first costs of renting an area, acquiring equipment, and working with team.

Tax-free Income With Infinite Banking

Individual fundings can be gotten from traditional banks and cooperative credit union. Below are some bottom lines to think about. Bank card can give a versatile means to obtain cash for extremely short-term durations. Obtaining cash on a credit report card is typically very expensive with yearly percentage prices of interest (APR) frequently reaching 20% to 30% or even more a year.

Latest Posts

Personal Banking Concept

How To Start A Bank: Complete Guide To Launch (2025)

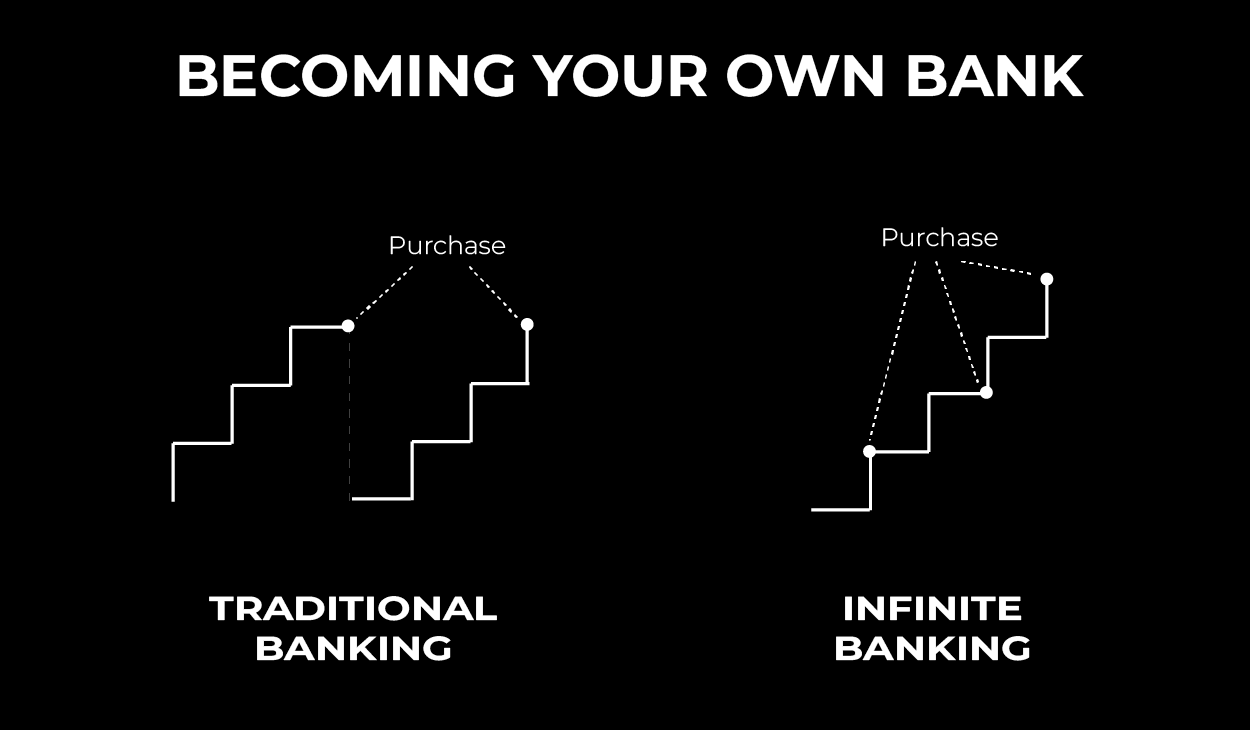

Becoming Your Own Banker Nash