All Categories

Featured

Table of Contents

The approach has its very own benefits, however it also has issues with high costs, complexity, and a lot more, resulting in it being considered as a scam by some. Infinite financial is not the ideal policy if you require only the financial investment part. The infinite banking concept focuses on making use of entire life insurance policy plans as a financial device.

A PUAR enables you to "overfund" your insurance plan right as much as line of it becoming a Customized Endowment Contract (MEC). When you use a PUAR, you quickly enhance your cash worth (and your survivor benefit), consequently boosting the power of your "financial institution". Better, the even more cash money value you have, the greater your passion and reward payments from your insurance provider will certainly be.

With the increase of TikTok as an information-sharing system, monetary advice and approaches have actually located an unique means of dispersing. One such strategy that has actually been making the rounds is the boundless banking principle, or IBC for short, amassing recommendations from stars like rapper Waka Flocka Fire - Infinite Banking cash flow. However, while the method is currently preferred, its roots map back to the 1980s when economist Nelson Nash presented it to the world.

Can I access my money easily with Leverage Life Insurance?

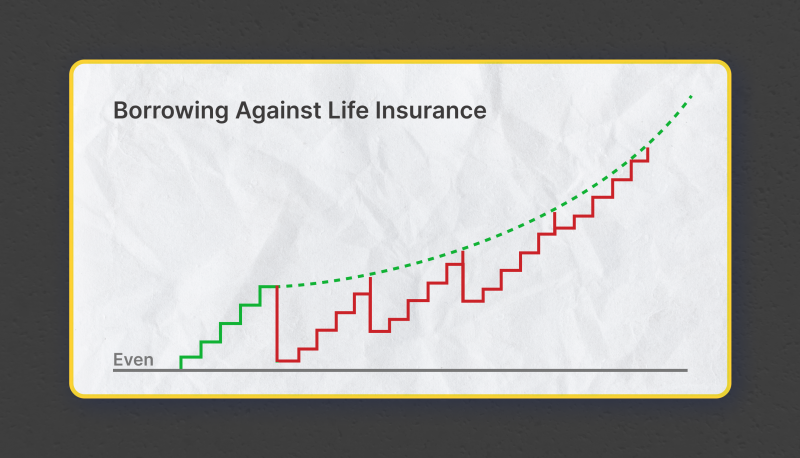

Within these plans, the cash worth grows based on a price established by the insurance firm. As soon as a considerable cash money worth accumulates, policyholders can obtain a cash value loan. These loans vary from traditional ones, with life insurance policy functioning as security, meaning one can shed their coverage if loaning excessively without sufficient money value to sustain the insurance coverage costs.

And while the attraction of these plans is noticeable, there are innate restrictions and dangers, necessitating diligent cash money worth monitoring. The technique's legitimacy isn't black and white. For high-net-worth individuals or entrepreneur, specifically those making use of strategies like company-owned life insurance coverage (COLI), the advantages of tax obligation breaks and compound growth might be appealing.

The attraction of unlimited banking doesn't negate its obstacles: Cost: The fundamental demand, an irreversible life insurance policy plan, is costlier than its term counterparts. Qualification: Not everybody receives whole life insurance policy due to rigorous underwriting processes that can exclude those with particular wellness or way of living problems. Intricacy and threat: The detailed nature of IBC, combined with its dangers, may hinder numerous, particularly when less complex and much less dangerous choices are offered.

What do I need to get started with Financial Independence Through Infinite Banking?

Assigning around 10% of your regular monthly income to the policy is simply not feasible for many people. Using life insurance as a financial investment and liquidity source calls for self-control and surveillance of plan money value. Speak with an economic advisor to determine if infinite financial aligns with your top priorities. Component of what you review below is just a reiteration of what has actually already been said over.

So prior to you get yourself into a scenario you're not planned for, understand the adhering to first: Although the principle is typically sold as such, you're not actually taking a funding from on your own. If that held true, you would not need to repay it. Rather, you're obtaining from the insurance provider and need to repay it with passion.

Some social media sites articles suggest using cash worth from whole life insurance policy to pay for credit score card financial debt. The idea is that when you pay back the financing with passion, the amount will be returned to your investments. That's not just how it functions. When you pay back the loan, a section of that passion goes to the insurer.

How does Infinite Banking compare to traditional investment strategies?

For the initial a number of years, you'll be settling the commission. This makes it exceptionally hard for your plan to accumulate value during this time around. Whole life insurance policy prices 5 to 15 times more than term insurance coverage. Lots of people merely can not afford it. Unless you can manage to pay a couple of to a number of hundred bucks for the next years or even more, IBC will not work for you.

Not every person must rely entirely on themselves for monetary protection. Wealth management with Infinite Banking. If you need life insurance policy, right here are some important pointers to consider: Consider term life insurance policy. These plans offer protection during years with substantial economic responsibilities, like home mortgages, pupil finances, or when looking after little ones. Make certain to look around for the very best rate.

Is Wealth Building With Infinite Banking a better option than saving accounts?

Picture never having to worry regarding financial institution loans or high interest prices again. That's the power of boundless banking life insurance policy.

There's no set lending term, and you have the liberty to choose the payment schedule, which can be as leisurely as paying off the loan at the time of death. This adaptability extends to the maintenance of the fundings, where you can select interest-only payments, maintaining the finance equilibrium level and workable.

How can Infinite Banking reduce my reliance on banks?

Holding cash in an IUL taken care of account being credited interest can often be better than holding the money on down payment at a bank.: You've constantly desired for opening your very own bakeshop. You can borrow from your IUL plan to cover the initial costs of leasing an area, acquiring tools, and employing personnel.

Personal car loans can be gotten from traditional financial institutions and cooperative credit union. Here are some bottom lines to take into consideration. Charge card can supply a flexible way to borrow cash for extremely temporary durations. However, borrowing cash on a charge card is generally extremely pricey with interest rate of interest (APR) frequently reaching 20% to 30% or more a year.

Latest Posts

Personal Banking Concept

How To Start A Bank: Complete Guide To Launch (2025)

Becoming Your Own Banker Nash