All Categories

Featured

Table of Contents

Nelson Nash. This book describes the Infinite Financial Principle (Self-financing with life insurance). To be straightforward, I would have rather been on the beach than rested in the condo listening to Daddy checked out a financial publication to us, however at the same time, I was thrilled because I saw that Dad was thrilled. My Dad is a Chiropractor.

He was in method long before I was birthed. It was on that trip, and particularly the message in that publication, Becoming Your Own Lender, that altered the course of our family members's life permanently. Here's an intro to the Infinite Banking Idea and exactly how McFie Insurance policy (previously Life Benefits) began.

Nelson Nash, served in the United States Flying force, worked as a forestry professional and later came to be a life insurance coverage representative and an investor. To obtain cash for his property investments prior to the 1980s, Mr. Nash was accustomed to paying 9.5% on the money he borrowed.

Nash explained in his book. Soon, Papa was on the phone informing family members and close friends about the Infinite Banking Idea. During the week, in his facility, he would certainly additionally inform his clients about guide and share the idea with them too. A couple of months later on, he decided to obtain his life insurance producer's license, so he might create, sell, and solution Whole Life insurance policy policies.

Can I use Cash Flow Banking to fund large purchases?

It had not been simply Papa's service. Mother was functioning along with him, and also as teens, we started assisting however we could. Prescription For Riches is offered as a complimentary e-book or audiobook download. If you've researched quite about the Infinite Banking Principle, there's a great chance you understand my Father as Dr.

You might have also check out among his publications or seen among his video discussions on YouTube. Actually, if you do not currently have it, you can get his most prominent book, Prescription for Wealth, as a complimentary electronic download. The forward to Prescription for Riches was written by Mr.

As the Infinite Banking Concept caught on, even more and more individuals began to desire dividend-paying Whole Life insurance policy policies. Life insurance policy representatives around the country began to make note. Some representatives enjoyed the idea, some representatives liked the thought of utilizing the concept as a sales system to market more life insurance policy.

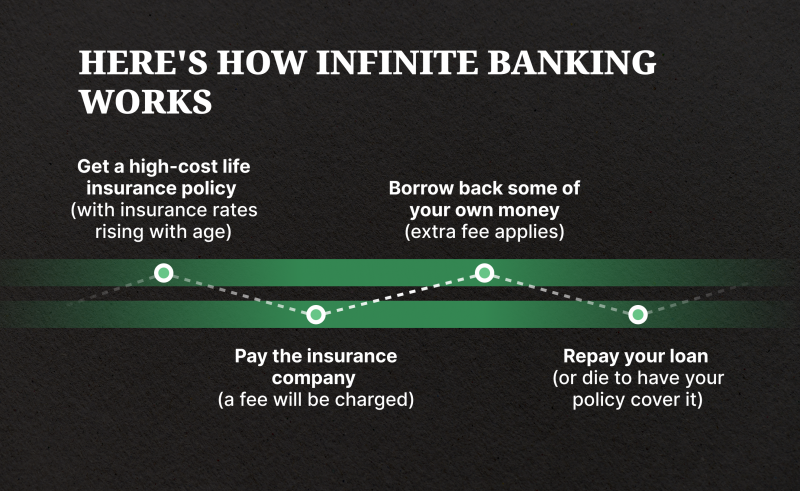

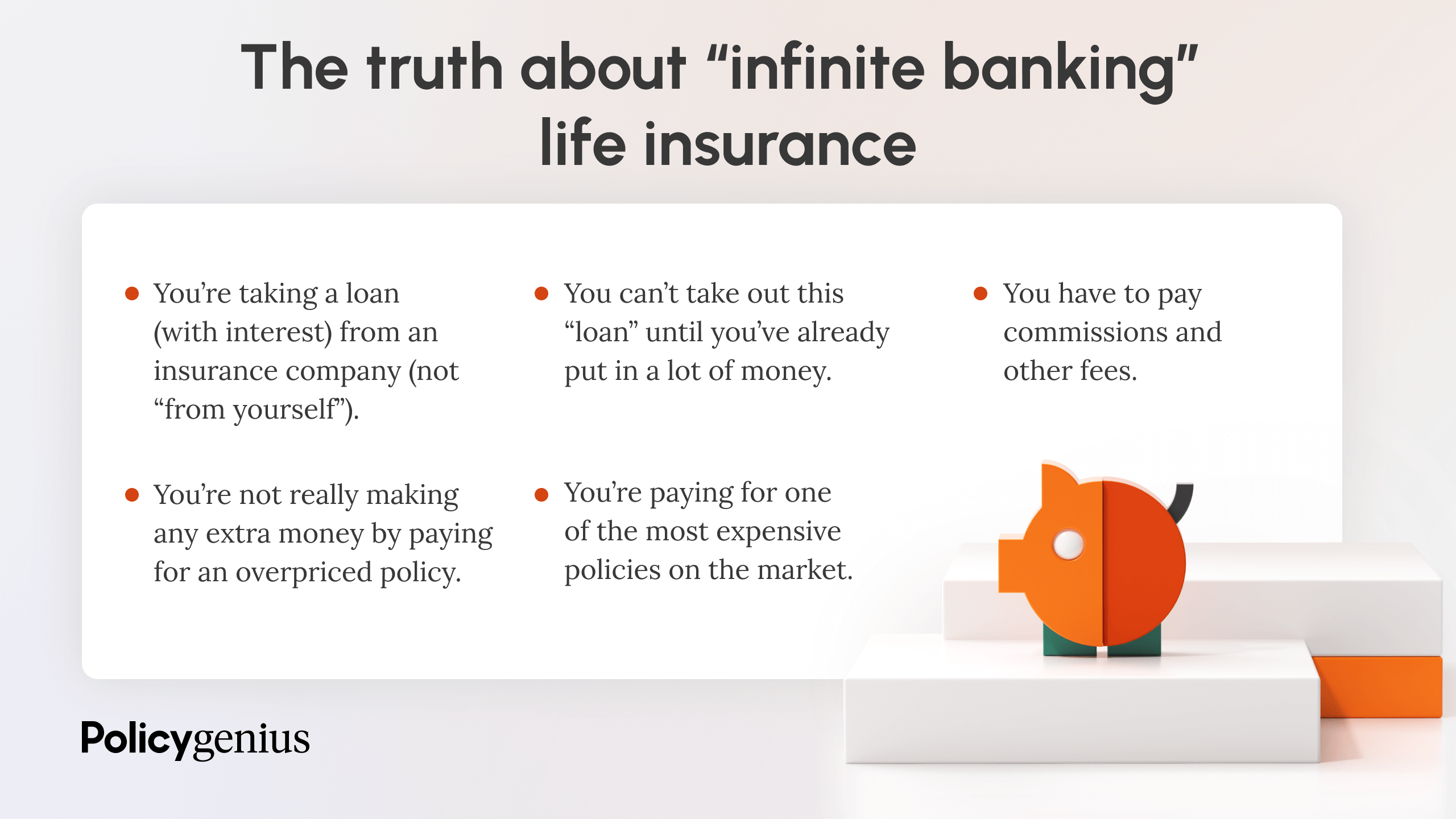

To develop a great policy that functions well for the Infinite Banking Concept, you need to reduce the base insurance policy in the policy and enhance the paid-up insurance rider. It's not tough to do, yet commissions are paid directly in connection to how much base insurance remains in the plan.

What are the most successful uses of Bank On Yourself?

Some agents are willing to cut their compensation to develop an excellent plan for the client, but many representatives are not. Several life insurance policy agents told their consumers that they were composing an "Infinite Financial Policy" however finished up writing them a poor Whole Life insurance coverage plan, or even worse, some type of Universal Life insurance plan, whether it was a Variable Universal Life insurance coverage policy or an Indexed Universal Life insurance plan.

Another danger to the idea came since some life insurance policy agents started calling life insurance policy policies "banks". This language captured the attention of some state regulatory authorities and restrictions taken place. Points have actually changed over the last a number of years. The IBC is still about, and it still functions. Mr. Nash's son-in-law, David Stearns, still runs the business Infinite Banking Concepts, which to name a few points, markets the publication Becoming Your Own Lender.

IBC is frequently called "boundless" due to its versatile and complex approach to personal financing management, specifically through the usage of entire life insurance coverage plans (Privatized banking system). This concept leverages the cash worth element of whole life insurance policies as a personal financial system.

Can anyone benefit from Infinite Banking Vs Traditional Banking?

This access to funds, for any kind of factor, without needing to get a car loan in the typical sense, is what makes the principle seem "unlimited" in its utility.: Making use of policy loans to finance service responsibilities, insurance, fringe benefit, and even to inject resources right into partnerships, joint endeavors, or as an employer, showcases the versatility and infinite possibility of the IBC.

As always, make use of discernment and hearken this advice from Abraham Lincoln. If you have an interest in limitless banking life insurance policy and are in the market to get an excellent plan, I'm prejudiced, however I suggest our household's business, McFie Insurance coverage. Not only have we specialized in establishing great policies for usage with the Infinite Financial Principle for over 16 years, but we also own and utilize the very same sort of policies personally.

Regardless obtaining a consultation can be important. Our household's company, McFie Insurance, offers an independent insurance testimonial at no cost. Call us today if you want ensuring your plan is properly designed and functioning for you in properlies. Whole Life insurance coverage is still the premier financial asset.

How long does it take to see returns from Infinite Banking Wealth Strategy?

I don't see that changing anytime quickly. Whether you're interested in discovering more concerning unlimited banking life insurance coverage or seeking to start making use of the principle with your own policy, call us to set up a totally free approach session. There's a great deal of complication around financing; there's so much to recognize and it's annoying when you don't recognize enough to make the best monetary decisions.

What is Infinite Financial and how does it function? Who is Infinite Financial for? If you're attempting to understand if Infinite Financial is ideal for you, this is what you require to recognize.

Too many individuals, himself included, got right into monetary difficulty due to reliance on financial institutions. In order for Infinite Financial to function, you need your very own financial institution.

How can Policy Loans reduce my reliance on banks?

The major distinction between both is that taking part entire life insurance coverage policies permit you to participate or get dividends based on revenues of the insurance coverage firm. With non-participating policies you do not participate or obtain dividends from the insurer. If you utilize a taking part whole life insurance policy for Infinite Banking, your cash money worth cash worth life insurance coverage rises each time the insurance provider pays dividends.

In addition, plan loans are tax-free. Relatively, if you withdraw your cash worth, any quantity over your basisthe amount you have actually contributed in insurance premiumswill be strained.

Dividend-paying entire life insurance coverage is extremely reduced threat and provides you, the insurance holder, a lot of control. The control that Infinite Financial provides can best be grouped right into 2 categories: tax benefits and possession securities. One of the reasons whole life insurance is ideal for Infinite Financial is exactly how it's exhausted.

Latest Posts

Personal Banking Concept

How To Start A Bank: Complete Guide To Launch (2025)

Becoming Your Own Banker Nash