All Categories

Featured

Table of Contents

A PUAR enables you to "overfund" your insurance plan right approximately line of it becoming a Changed Endowment Contract (MEC). When you utilize a PUAR, you swiftly boost your cash worth (and your survivor benefit), thereby enhancing the power of your "bank". Even more, the even more cash money value you have, the better your interest and returns payments from your insurer will be.

With the increase of TikTok as an information-sharing system, monetary recommendations and strategies have discovered an unique way of spreading. One such strategy that has actually been making the rounds is the unlimited financial idea, or IBC for brief, garnering recommendations from stars like rapper Waka Flocka Fire. While the technique is currently preferred, its roots trace back to the 1980s when financial expert Nelson Nash introduced it to the world.

What is Wealth Building With Infinite Banking?

Within these policies, the cash money value expands based upon a rate established by the insurer (Leverage life insurance). As soon as a substantial money value gathers, insurance policy holders can acquire a cash money value loan. These financings differ from traditional ones, with life insurance policy functioning as collateral, indicating one can shed their coverage if loaning exceedingly without adequate money worth to sustain the insurance coverage costs

And while the appeal of these plans appears, there are natural constraints and risks, demanding persistent cash money worth tracking. The approach's legitimacy isn't black and white. For high-net-worth people or company owner, specifically those making use of strategies like company-owned life insurance policy (COLI), the advantages of tax breaks and compound growth might be appealing.

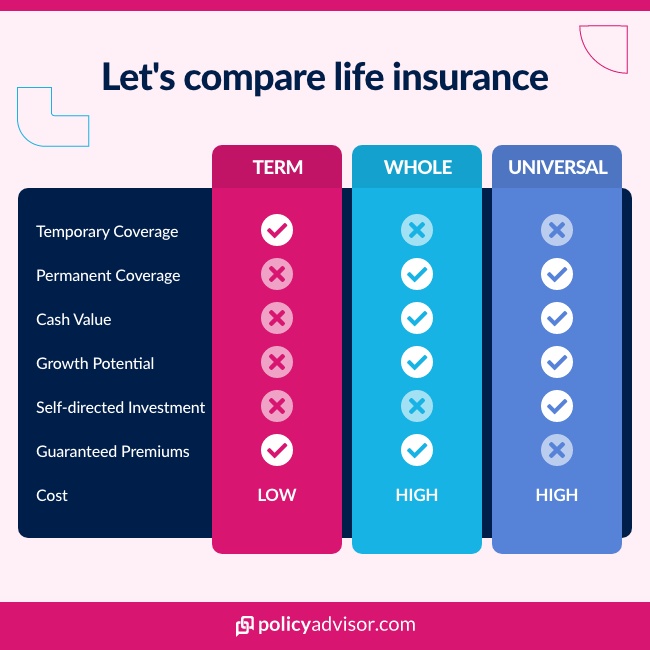

The attraction of infinite financial does not negate its difficulties: Expense: The fundamental demand, an irreversible life insurance policy plan, is pricier than its term equivalents. Qualification: Not every person qualifies for whole life insurance policy because of extensive underwriting processes that can leave out those with certain health or way of living problems. Complexity and risk: The elaborate nature of IBC, paired with its threats, might hinder numerous, especially when easier and much less risky alternatives are offered.

What are the tax advantages of Life Insurance Loans?

Designating around 10% of your monthly earnings to the plan is just not practical for the majority of people. Part of what you read below is merely a reiteration of what has actually currently been said above.

Prior to you get yourself into a situation you're not prepared for, recognize the following initially: Although the concept is generally marketed as such, you're not in fact taking a financing from yourself. If that held true, you would not need to repay it. Instead, you're borrowing from the insurance business and have to repay it with rate of interest.

Some social media messages recommend making use of cash money value from whole life insurance policy to pay down credit report card financial debt. The idea is that when you pay off the lending with passion, the amount will be sent back to your financial investments. That's not how it works. When you pay back the lending, a portion of that passion mosts likely to the insurer.

For the first numerous years, you'll be paying off the payment. This makes it extremely tough for your plan to build up value throughout this moment. Whole life insurance policy costs 5 to 15 times more than term insurance coverage. Many people merely can not afford it. Unless you can pay for to pay a couple of to numerous hundred dollars for the next years or even more, IBC will not work for you.

What are the risks of using Infinite Banking Retirement Strategy?

Not everyone ought to depend only on themselves for economic safety and security. If you need life insurance policy, here are some useful pointers to think about: Take into consideration term life insurance. These policies offer insurance coverage during years with considerable economic obligations, like home mortgages, trainee finances, or when looking after little ones. Make certain to shop about for the best price.

Imagine never having to fret about bank finances or high interest rates again. Suppose you could obtain cash on your terms and build riches all at once? That's the power of infinite banking life insurance policy. By leveraging the cash money worth of entire life insurance policy IUL plans, you can expand your riches and borrow cash without counting on traditional financial institutions.

There's no collection loan term, and you have the flexibility to select the repayment routine, which can be as leisurely as settling the loan at the time of fatality. Tax-free income with Infinite Banking. This adaptability encompasses the maintenance of the car loans, where you can go with interest-only repayments, keeping the financing equilibrium level and workable

Holding money in an IUL fixed account being attributed passion can often be much better than holding the cash money on down payment at a bank.: You have actually always dreamed of opening your very own bakeshop. You can borrow from your IUL policy to cover the preliminary expenditures of renting a space, purchasing equipment, and working with staff.

Cash Flow Banking

Personal car loans can be obtained from traditional financial institutions and lending institution. Here are some bottom lines to consider. Bank card can offer a flexible way to obtain money for extremely short-term periods. Borrowing money on a credit report card is generally really costly with yearly percentage rates of interest (APR) frequently reaching 20% to 30% or even more a year.

Latest Posts

Personal Banking Concept

How To Start A Bank: Complete Guide To Launch (2025)

Becoming Your Own Banker Nash